Chainalytics Labs Portfolios

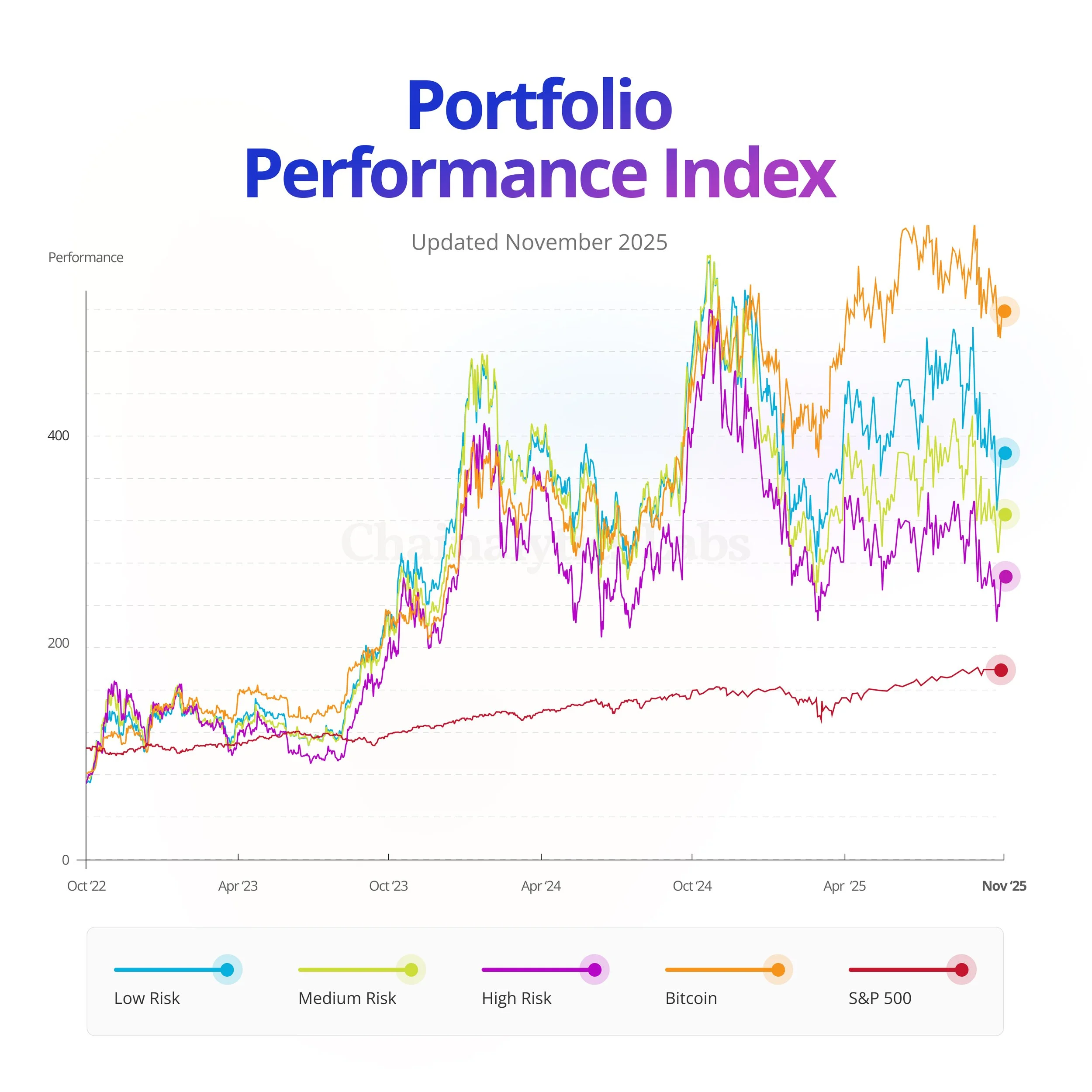

Just as we offer you guidance and insights, we apply the same principles to the Chainalytics Labs Example Portfolios. As a member, you will receive emails showcasing the performance of these portfolios, built and optimized using the same data-driven models we're sharing with you.

HOW WE BUILT the chainalytics Labs PORTFOLIOs

The Chainalytics Labs Portfolios are simulated, assuming a lump sum investment starting in July 2022. We chose that date because it was the optimal time to buy according to our data-driven Crypto Market Phase Indicator, which you can now also use.

We would have invested in BTC, ETH, SOL and the 3 most undervalued blockchains at that time, according to the insights of our Example Portfolios. This is what our portfolios looked like initially:

HOW we OPTIMIZE Chainalytics labs PORTFOLIOs

Since then, the Chainalytics Labs Portfolios have been rebalanced every two months. This approach ensures that each portfolio remains aligned with its corresponding risk profile while also maximizing future profits. As a valued member of Chainalytics Labs, you'll also receive our Rebalancing Signals, providing you with valuable insights to inspire your own portfolio rebalancing decisions.

How we could take profits from the chainalytics labs portfolios

Additionally, we've developed our data-driven Crypto Market Cycle Indicator to ensure optimal timing for selling and buying. As a member, you'll receive precise signals of when we plan to sell and when we will buy, empowering you to leverage our insights in making your own informed decisions.